“White Gold” Furore

Currently, Argentina is the third world producer of lithium carbonate and is shaping up to take second place by 2022. Puna salt flats have become the new “star” of the local mining market with 2 projects in operation, other 3 projects in construction and 14 in advanced exploration.

The Lithium market is in an upward cycle worldwide and Argentina has joined this process as a lithium carbonate supplier (LCE), an essential commodity for the production of batteries in the electronic industry and the market of the electric cars that is making a big impact. “ In recent years -as the Secretary of Economic Policies of The Ministry of Finance stated- the lithium exploration in Argentina has shown a dynamism superior to that of other minerals, based on several factors: demand prospects and favorable prices; lower capital requirements, involvement of non-mining industrial companies and restrictions on the installation of projects in Chile and Bolivia”.

The salt flats of the two last South American countries mentioned above make up, along with the ones of the Argentinian Puna, the so-called “lithium triangle” that accounts for 80 % of the world lithium brine resources. “The natural brine deposits have the highest lithium concentration, as the dissolved element is found there as ion , as well as in the groundwater of some salt flats, accompanied by potassium, magnesium and boron”, explain the investigators Mauro de la Hoz, Verónica Rocío Martínez and José Luis Vedia, from the Conicet and the National University of Salta, in their work “The lithium: from the salt flats of Puna to our cell phones”.

A significant scientific contribution of our country has been the development of a sustainable method of lithium extraction in high altitude salt flats, which is both more efficient and ecologically friendly than the evaporation of brine by solar radiation that is the prevailing method now and affects in a non-negligible way the scarce water resources of the Puna. The team of Chemistry Physics of the Materials. Environment and Energy (Inquimae) of Buenos Aires University (UBA), led by Ernesto Calvo, came up with an innovative electrochemical process in the form of a small reactor that has already been successfully tested in the laboratory and patented by Conicet.

Local market situation

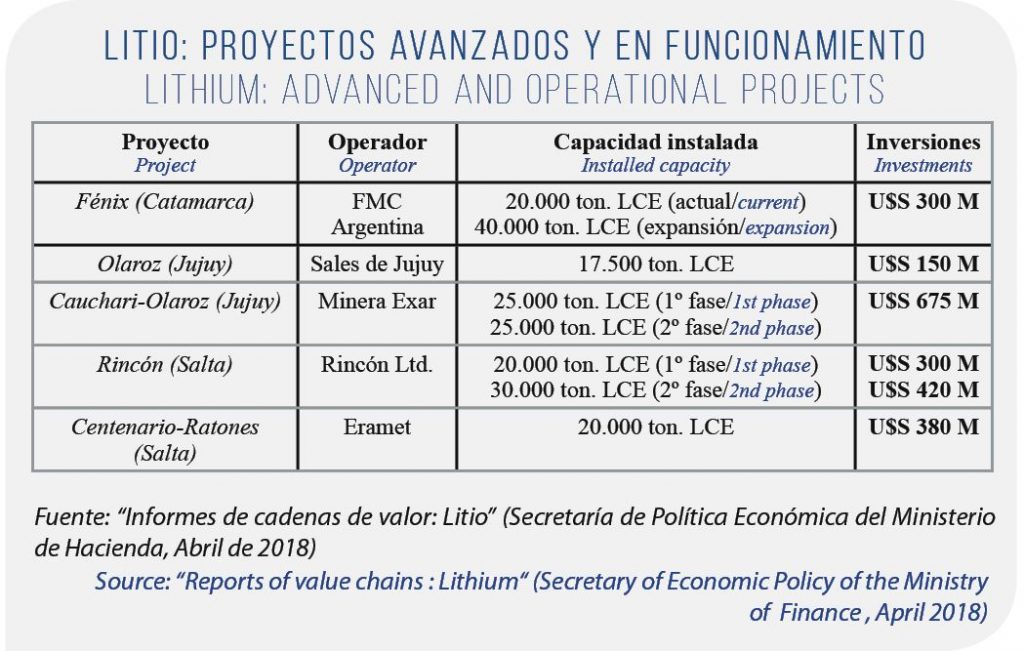

The international price of the lithium carbonate ton is quoted at around 13,000 dollars. Last year Argentine export of LCE totalled 251 million dollars, which entails tripling the value exported 10 years ago. The two companies that currently operate in the country are Minera del Altiplano, local subsidiary of the American Livent Corporation (ex FMC Lithium), that has been in charge of the Fenix project in the Salar del Hombre Muerto (Catamarca) since 1998; and Sales de Jujuy, which is a consortium made up of the Australian Orocobre and the Japanese Toyota Tsusho. The state provincial Jujuy Energia y Mineria (Jense), in the Salar de Olaroz (Jujuy) also participates as a minority partner.

Minera del Altiplano’s expansion plan was approved by Catamarca authorities last year. Its aim was to double its production capacity and go from 20,000 to 40,000 tons of LCE per year, which would mean a 300 million dollars investment. For its part, Sales de Jujuy started up its plant in 2016, with a 150 million dollars investment and nowadays it produces 17,500 tons of LCE although the company assures that “the operation has been designed to expand its capacity with additional developments in planned stages according to the market demand”

A strong expansion expectation

Minera Exar, is the most advanced project in construction out of the three other ones. It is a joint-venture between the Canadian Lithium Americas and the Chinese Ganfeng Lithium that exploits the project Cauchari-Olaroz and has a total investment of 675 million dollars being developed.

Jemse also participates in this project. The first of the twenty-two extraction wells was inaugurated by the end of last year and it is expected that for the first term of 2020 the chemical plant will be producing the first ton of lithium carbonate. In its first phase, the company will have a production capacity of 25,000 tons and it is expected that additional 25,000 tons will be produced in a second stage.

For its part, Rincon Mining, with Canadian capital, plans to invest this year around 300 million dollars to start the construction of its modular plant of lithium carbonate in the Salar del Rincón (Salta), with an initial output of 25,000 tons. In a second phase, with an additional investment of 420 million dollars, it is planned to add 30,000 more tons in a second plant that would be finished by 2022. Finally, the French Eramet has announced a 380 million dollars investment in its project in the salt flats Centenario and Ratones, in the Puna in Salta. The plant, with a projected capacity of 20,000 tons of LCE, would be in its production stage by the end of the next year.

“The coming into force of the most advanced projects along with the expansion of the current ones, in a context of high prices, could significantly expand the national lithium exports in the following five years”, the Secretary of Economic Policy outlines in the report already mentioned. Forecasts are very promising as – according to the previously mentioned body- “under a hypothesis of maximum growth of the installed capacity in the country, taking into account the short term income of all the announced projects, without any technical or financial delay, the Argentine participation (in the global market ) could increase from 15 % in 2017 to 25/30 % in 2022”.

Argentina and the lithium value chain

The main purpose of the lithium carbonate is the production of lithium-ion batteries, whose installed capacity is mostly concentrated in Asia, where the main electronic companies are located –the South Corean ones like Samsung and LG and the Japanese companies Sony and Panasonic/Sanyo. The automotive industry, leaders of technological innovation, are also placed there though it should be worth mentioning the role played by the American company Tesla, led by Elon Musk. It inaugurated Gigafactoria 1 in Sparks (Nevada) in 2017 and will be fully operating by 2020. This year, Tesla will be inaugurating another Gigafactoria in Shangai (China ) that will also produce lithium-ion batteries for its electric cars.

While talking about Argentina’s place in the lithium business, Matías Ubogui, from the Argentine Association of Electric and Alternative Vehicles (AAVEA), states : “We are in the first part of the chain and additional value-added processes can be done, as the increase of the mineral purity. But, it will be very difficult to reach the cells production for batteries because for a factory of this type to be profitable , an enormous scale is necessary and if there is not a strong local demand, there will neither be any possibility of developing it at a sufficient scale so that the local production of cells can become competitive”. As regards the lithium purity, it is worth noting that it is necessary to reach the so-called “battery grade”; that is purity of no less than 99.6 % , for the manufacture of compounds for batteries.

The creation of Jujuy Litio S.A., a joint venture between the provincial company Jemse (60 %) and the Italian company FAAM (40 %), specialized in systems of power storage, is the first step for the local production of lithium-ion batteries. Our modest aim is the installation of a factory in the Industrial Park of Perico designed to produce cells for batteries with an estimate of a yearly output of 68.6 tons of LCE. They would be intended, in principle, for passenger transport. It must be remembered that the electrification of urban mobility is the goal set by large Latin American cities and in the case of Buenos Aires , a pilot plan has just started whose aim is the incorporation of eight electric buses in four bus lines that run along downtown and the suburbs, the 12, the 34 and the 59.

Anyway, the context of economic difficulties our country is going through is the main obstacle to the development of that power transition at the short term. At the moment, the most significant progress had to do with the installation of new exploration projects and the creation of new plants for the production of lithium carbonate, which would allow to increase the significant role of Argentina in the international lithium market.